How To Register A Company In New Jersey

1 of the first decisions y'all'll need to make when starting a business in NJ is to choose your business concern entity blazon. There are several different business structures to choose from, simply the limited liability company (LLC) is 1 of the near popular.

An LLC is a hybrid between a partnership and a corporation. Like corporations, members of an LLC aren't personally liable for business concern debts. Just like partnerships, LLCs are relatively easy to form and maintain.

Forming an LLC in NJ

In society to create an LLC in New Bailiwick of jersey, you'll need to register your LLC with the NJ Division of Revenue . This agency sets the requirements and filing fees for forming an LLC in New Jersey. This is also the bureau you lot'll register with if y'all created an LLC in another state only would like to operate in New Bailiwick of jersey.

Step ane: Choose a name for your NJ LLC

When forming an LLC in New Bailiwick of jersey, yous'll first demand to choose a business proper noun. Nether NJ law, the proper noun y'all choose has to exist unlike from the names of other business organization entities that are on file with the Division of Revenue. This requirement helps ensure that customers and members of the public don't misfile your business with some other.

The name for your NJ LLC has to end with "Express Liability Company," "LLC" or "Fifty.L.C." You can use the abbreviations "Ltd." or "Co." The apply of certain words in your business concern names, such as "bank" or "insurance," requires special permission from state agencies.

In order to ensure that your LLC's name is available, y'all should do a preliminary name check on NJ's Business Name Database . If the name is available, you'll be able to reserve it for up to 120 days using an Application for Reservation of Name . This reservation holds the name until you're able to file your certificate of formation (run across step iv). Keep in mind that the Segmentation of Acquirement doesn't check names for trademark compliance. Information technology'south ultimately upwardly to you and your business chaser to ensure that your LLC's proper name doesn't borrow on any other visitor'southward rights.

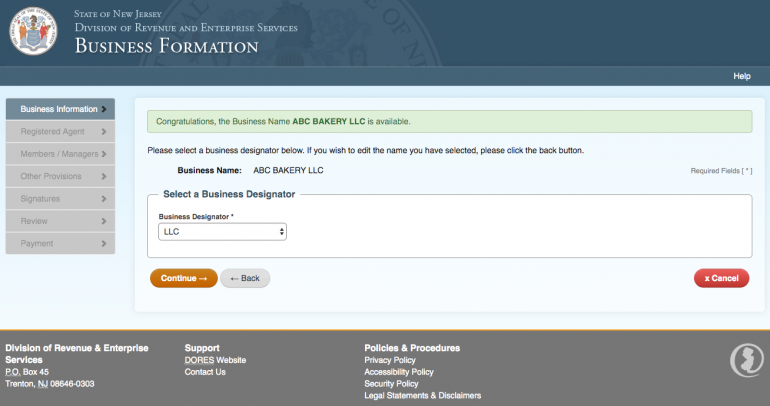

Source: NJ Division of Revenue and Enterprise Services

Footstep two: Choose a registered agent in NJ

Every LLC that operates in New Jersey must proper noun a registered agent that will accept legal and official postal service on the LLC'southward behalf. A registered agent for a New Bailiwick of jersey LLC tin can be either an individual or a company. The registered agent volition exist among the offset to notify yous if your business gets sued or receives an official find from the government.

When forming an LLC in NJ, an individual can serve as a registered agent as long equally they are a country resident. This includes a member or director of the LLC. Alternatively, a visitor that's authorized to operate in New Jersey can serve as the registered agent for a business. The registered amanuensis of your NJ LLC must have a physical accost in New Jersey (P.O. boxes are non sufficient), which is called the registered office.

Many businesses opt to employ an online legal service equally their registered agent, such as Incfile, which is licensed to provide registered amanuensis services in all l states. If you lot course your LLC on Incfile, you'll also receive 1 year of free registered agent service.

Step three: Obtain an NJ business concern license

Companies in select industries demand a business license to operate in New Jersey. Most of these companies are in skilled or heavily regulated sectors, such equally construction, nutrient service and childcare. New Jersey's Business Action Eye maintains a list of industries that require licenses, and so yous tin can check if whatever requirements apply to your small business organization.

If your business uses a merchandise name that's unlike from the company's legal name, you must register the trade name with the Sectionalization of Acquirement. New Bailiwick of jersey calls such trade names "alternate names." Other states use the term "fictitious business proper noun" or "DBA" ("doing business as" proper name). The fee to register an alternating name is $l, and the process can be completed online, by mail service or over the counter at the Division of Revenue's Trenton, New Bailiwick of jersey office.

Businesses in New Jersey that sell taxable goods or services must annals to collect sales tax with the Partitioning of Revenue. After registering, you'll need to file quarterly returns and transport in quarterly payments of the sales taxation. Some high-volume sellers accept to file monthly returns and make monthly payments.

Step 4: File your certificate of formation

The adjacent step — and the most important i — when forming an LLC in New Jersey is to file your document of formation with the NJ Division of Revenue. The certificate of germination, sometimes referred to as the articles of organization, officially establishes your authority to operate every bit a New Jersey LLC. Although yous tin can request a newspaper copy of the course, the quickest option is to file your certificate of germination online . The filing fee for the certificate of germination is $125.

You'll need the following information to consummate the certificate of formation:

-

The LLC's proper name, purpose and date of germination.

-

Registered agent's name, email and New Jersey street address (P.O. boxes are non acceptable).

-

Dissolution date (if your LLC volition cease on a specific date).

-

Signature of the member or authorized person completing the course.

Along with the above items of information, foreign LLCs — those that are formed in another state but want to operate in New Jersey — must include a certificate of good standing from their domicile country when filing their document of formation. Strange LLCs pay the same filing fee of $125.

If yous file your certificate of germination online, you'll receive instant online confirmation of your filing and a printable certificate. The state will also mail a filing notification to your registered amanuensis's address inside iii to 10 concern days after filing. Certificates of formation that are mailed in will have a few extra days to process.

Step 5: Draft an LLC operating agreement

Unlike the neighboring country of New York, New Jersey LLCs aren't required to have an LLC operating agreement. That said, even though it isn't legally required, we recommend that every LLC prefer a written operating understanding. When forming an LLC in New Jersey, the operating understanding sets the design for your LLC's day-to-day operations and prevents conflicts among co-owners.

At a minimum, the LLC operating understanding should include this data:

-

The purpose of the LLC, including products or services offered.

-

The names and addresses of each member (and the manager, if there is 1.

-

Each member's financial contributions to the LLC.

-

Each member's ownership stake in the company, voting rights and profit share.

-

The process for admitting new members to the LLC.

-

The procedure for electing a director if the LLC is manager-managed.

-

The LLC's meeting schedule and voting procedures.

-

Dissolution procedures.

All members should exist given an opportunity to review and sign the operating agreement. At that betoken, y'all can shop the understanding with other business records. Should yous need some extra assistance in drafting your operating agreement, you tin can also use a service like IncFile to course your LLC.

Footstep 6: Comply with land and federal obligations

Choose how you want your LLC to exist taxed

LLCs tin can choose to exist taxed as pass-through entities or corporations. If you opt for a laissez passer-through entity, your LLC doesn't pay whatsoever state or federal taxes of its own. Instead, the members report their share of the business'southward income and losses on their personal taxation return. If you lot opt to be taxed every bit a corporation, however, so yous'll be subject to NJ'due south corporation business organisation revenue enhancement and federal corporate tax rates.

Obtain an EIN

In order to file federal taxes, your LLC might need an employer identification number (EIN). An EIN is required for LLCs with employees or multiple owners, as well as those taxed as corporations for federal tax purposes. Additionally, an EIN will exist necessary when you're opening a business bank account or credit card, likewise as if you apply for financing.

File annual reports

New Bailiwick of jersey LLCs also have to file an annual report , accompanied by a filing fee of $l to $75. The report is due on the terminal twenty-four hours of the anniversary month of the business'south formation. For case, if you lot filed your certificate of formation on March iii, your annual written report would be due by March 31 of the successive year and each post-obit year. The annual written report keeps your business'due south data, such equally your registered agent'south name and accost, up to date with the state.

Comply with employee obligations

-

Employee reporting: Under both state and federal law, employers must report new employees inside 20 days of their hire date to the New Bailiwick of jersey New Rent Reporting Center .

-

Pay unemployment taxes: In New Bailiwick of jersey, most employers have to kickoff paying unemployment insurance taxes once their payroll reaches $1,000.

-

Employer withholding: New Bailiwick of jersey employers must withhold land and federal income taxes and payroll taxes from their employees' wages.

-

Purchase workers' compensation insurance: All businesses in New Jersey with employees need to buy adequate workers' compensation insurance . LLC members do non count as employees.

There could be additional employer obligations when you create an LLC in New Jersey, such every bit observing the minimum wage constabulary. We recommend hiring a concern attorney who's experienced in New Bailiwick of jersey employment constabulary to help you stay in compliance.

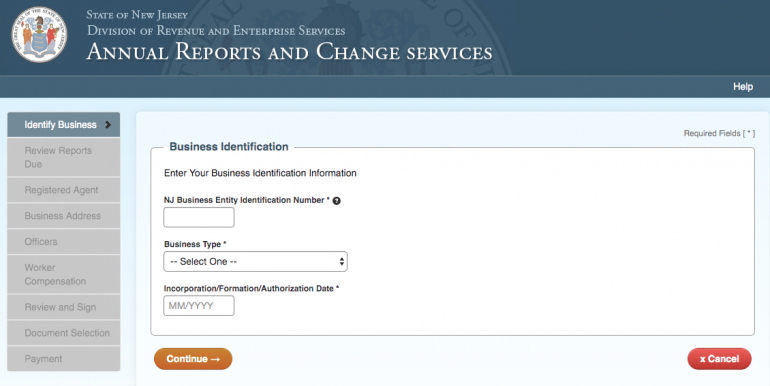

Source: NJ Sectionalization of Revenue and Enterprise Services

Pros and cons

If you're thinking almost creating an LLC in New Jersey, consider these advantages and disadvantages.

Pros

-

Members of an LLC are not personally liable for business concern debts and lawsuits (equally long as separation is maintained between concern and personal finances).

-

LLCs accept fewer recordkeeping requirements than corporations.

-

LLC members can choose their concern's tax treatment.

-

Past default, LLCs are pass-through entities for tax purposes and avert the double taxation of C-corporations.

Cons

-

LLC members must pay high federal self-employment taxes.

-

Corporations are ameliorate suited than LLCs for raising coin from outside investors.

-

LLC members tin can't accept a bacon, and all draws from the business are subject to income taxes.

A version of this article was first published on Fundera, a subsidiary of NerdWallet.

Source: https://www.nerdwallet.com/article/small-business/llc-nj

Posted by: fitzgeraldreld1996.blogspot.com

0 Response to "How To Register A Company In New Jersey"

Post a Comment